Innovation Spotlight

Before the summer of 2024, I had never even heard of Xapien. Now? I can’t stop talking about them.

They’re changing the game when it comes to how due diligence is done. Let me explain.

The Old Way of Doing Things

This is how most professional firms onboard clients.

Compliance or business support professionals begin by collecting client data via questionnaires and forms. This data is then manually entered into multiple tools, often requiring repetitive retyping and cross-checking to ensure accuracy.

The data is then analysed to identify and eliminate false positives before being consolidated into a report. This report is then passed on to the next level for risk assessment. The entire process can last 2 to 6 weeks, averaging at 4 for firms that do b2b work.

This process kicks in when companies onboard new clients, review vendors, or vet counter-parties and existing clients. Firms have to do this under their regulatory obligation to prevent financial crime.

Here’s the kicker

Most RegTechs on the market are basically sandboxes. They rely on various plugins from data providers, but they don’t actually do the work for you. For example, an end to end client onboarding tool would have these plugins as their individual products:

- KYB Aggregators: Think Dun & Bradstreet, Know Your Customer, Open Corporate, and others that pull business registry data.

- KYC Tools: Services like GBG, Onfido, and Credas that guide you through identity verification.

- Screening & Monitoring Tools: ComplyAdvantage or LSEG for sanctions, adverse media, and politically exposed persons (PEP) data.

- Payment Monitoring & Source of Funds: Tools like Armalytix or Thirdfort to ensure transactions are clean.

Every RegTech tool is essentially a blank slate. They might offer some differences like pre-set questionnaires or risk assessment modules, but ultimately, the heavy lifting is still on you. You have to do all of the work.

Enter Xapien

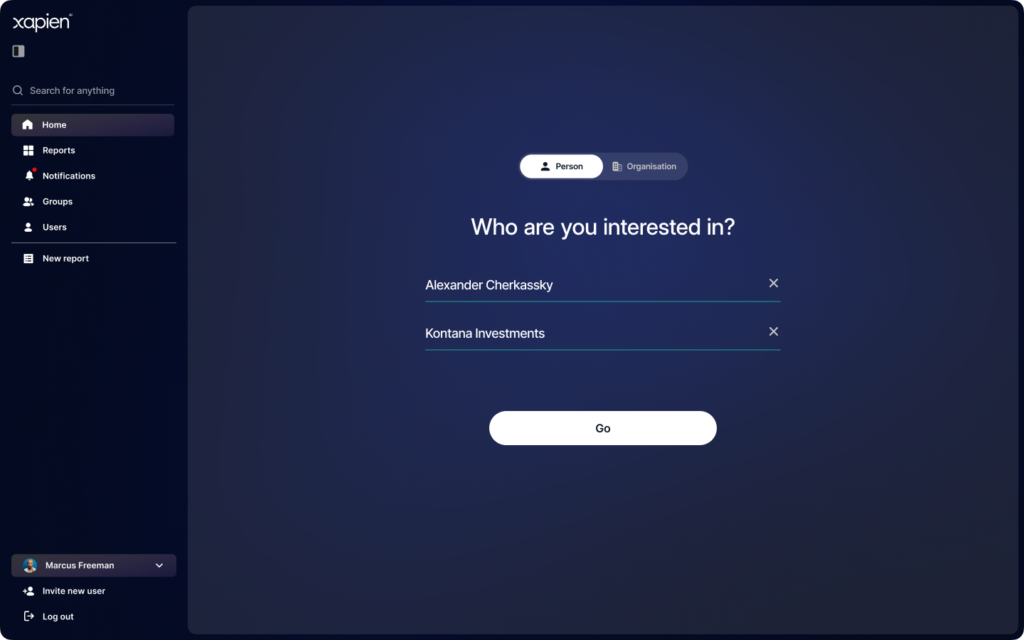

Now, this is where Xapien comes in. Imagine typing the name of an individual or entity into a search bar, hitting “Go,” and then just…chilling.

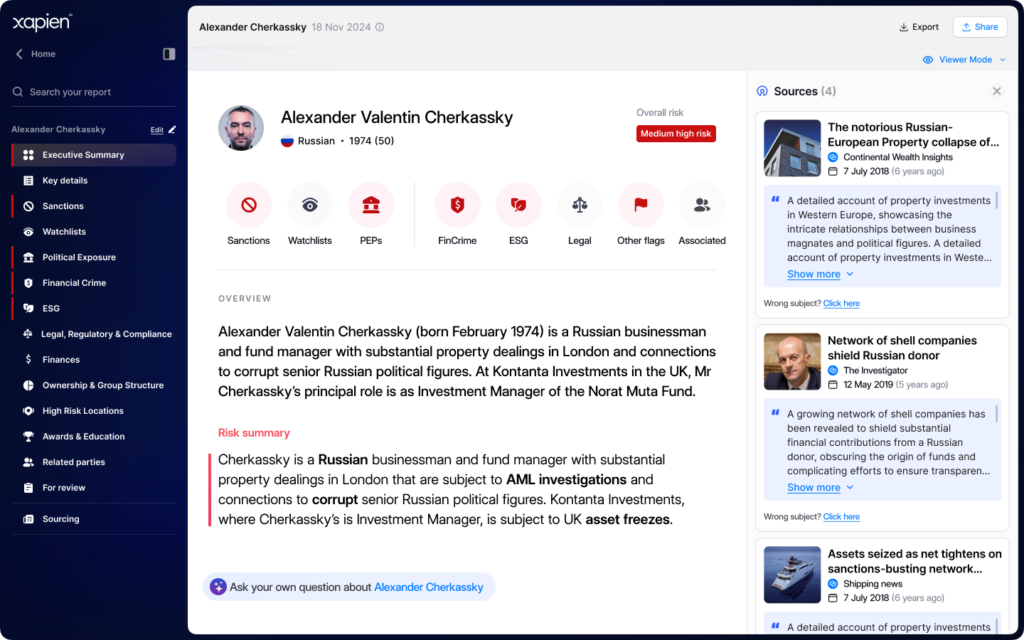

Xapien, in minutes, gathers the corporate or individual data, uses AI and machine learning to map out ownership structures, identifies Ultimate Beneficial Owners, and checks directors and entities for Sanctions, PEP or any sort of media on the web. It even handles false-positive remediation and consolidates everything into a clean, comprehensive report. It also gathers LinkedIn accounts and creates profiles for each involvement in a structure. It brings your customer to life.

All you have to do is enter an entity name and it gives you a full, nuanced picture of who or what you’re dealing with.

Real-World Results

We ran a test report on Holland & Barrett Retail, specifically one of their subsidiaries, H&B Retail. This wasn’t some big, obvious name, it was a small fish in the middle of the corporate chain.

Xapien still nailed it. The report showcased:

- A mix of adverse and positive media, neatly categorized and summarized with direct sources.

- A timeline view that made it super easy to track key events and insights.

- Ownership structures, directors, and UBOs mapped out with remarkable precision.

In less than 10 minutes, we had a report that would’ve taken a team of compliance officers or myself a week to put together.

This is not paid content.

I want to stress that this is my analysis of Xapien and the market. I like the concept of what Xapien does and I think it has mainstream potential, especially as its AI develops and matures. They are currently working with Pinsent Masons to develop the product for a legal use case.

Highly suggest you check them if you want too the best use case of AI for AML Compliance.

You can also check out our review of Xapien here.