RedFlagAlert

Functionality

End-to-End Due Diligence

Description

Red Flag Alert provides detailed KYB and KYC checks, insolvency warnings, and other solutions to a wide range of industries.

Share

Bio

Founded in 2003, Red Flag Alert began as a business intelligence tool to monitor companies in financial distress and alert insolvency practitioners like Begbies Traynor. Over time, the company evolved into a SaaS-based business offering credit referencing, compliance, and risk management tools. Today, Red Flag Alert provides detailed KYB and KYC checks, insolvency warnings, fraud prevention measures, and compliance solutions to a wide range of industries.

Year Founded

2003

Locations

UK, Europe

Key Market

Financial Services

Features

Adverse Media

Credit Checks

Document Verification

Insolvency Checks

KYB

KYC

Ongoing Monitoring

Screening

UBO Mapping

Market Focus

Segmentation

- SME

- Mid Market

- Enterprise

Target Markets

- Financial Services (Likes of Santander & Barclays)

- Construction

- Professional Services (Legal, Accounting & Insolvency)

Local Group

- CreditSafe

- D&B

- LexisNexis

- SS

Data sources and Integrations

- CRMs: Salesforce, Hubspot, Pipedrive.

- Screening: ComplyAdvantage

- KYC: ID4S, GBG.

- KYB & Other: Dun & Bradstreet, Equifax, Experian.

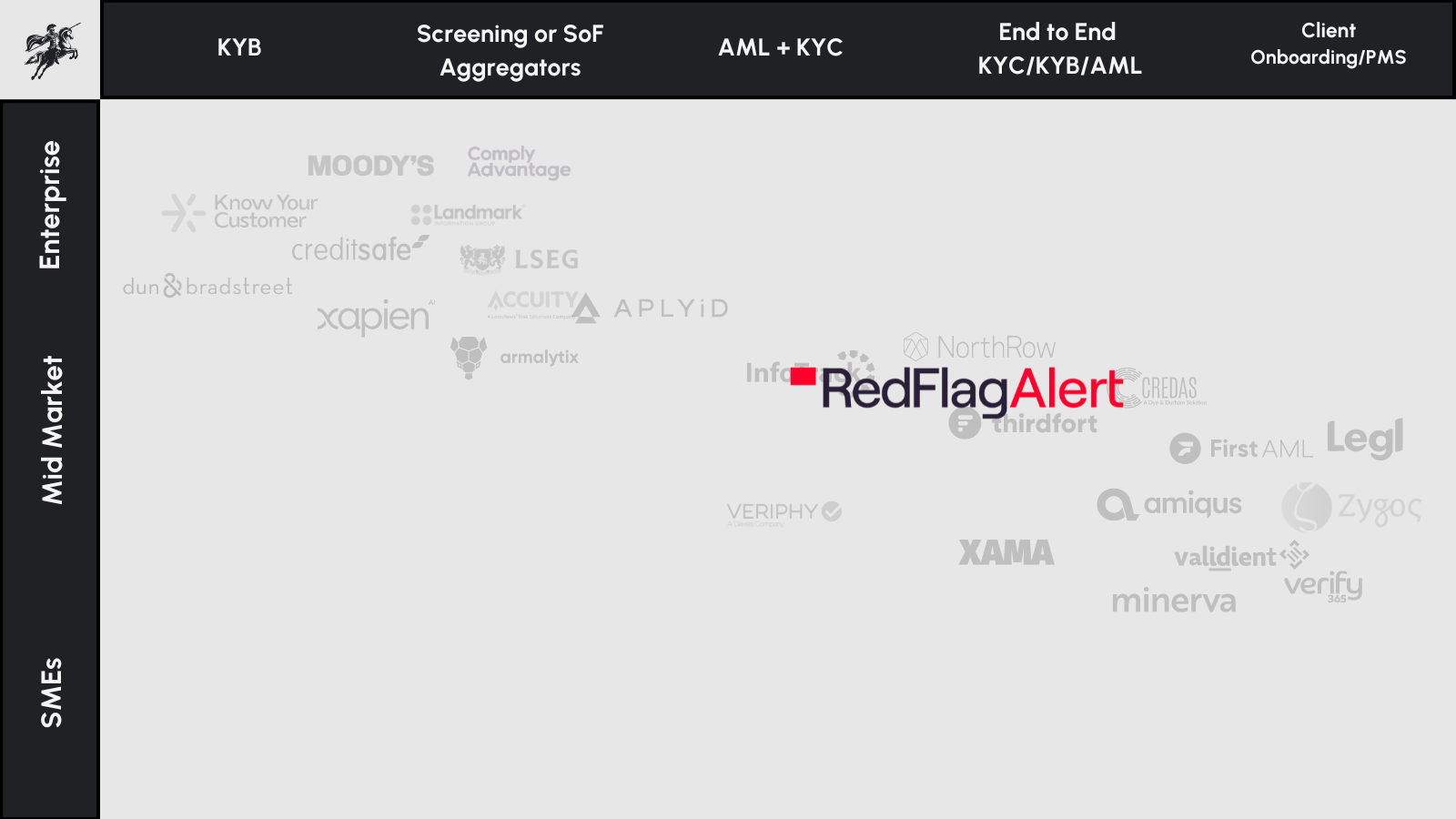

Market Map

Strengths

- The depth of data it provides on KYB is beyond impressive

- Very impressive Credit & Insolvency monitoring

- Platform is end to end for AML, KYC and KYB - great for volume onboarding and managing tons of entities.

Weaknesses

- Lacks broader risk/onboarding features like CRAs, Payment, Signature, Forms, etc

- No data flow across KYB and KYC

- Lacks bulk remediation and verification capabilities

Pricing

- Subscription-based pricing with optional Pay-As-You-Go Module

Aventine Rating

Aventine Comment

Excels at KYB like no other, the amount of data points is amazing, however, it could improve on flow of data and adding features to allow full client onboarding within the system

Raised

£4.5m

Round Details

Raised £4.5 million in 2023 from Uncapped and Foresight Group.

Investors

- Uncapped

- Foresight Group

Executives

Richard West

Managing Director - Co Founder

James Wilson

Chief Technology Officer

Marc Williams

Chief Revenue Officer

N/A