Omnitrack - VinciWorks

Functionality

Description

Share

Bio

Year Founded

Locations

Key Market

Features

Case Management

Direct API

Identity Verification

KYB

KYC

Ongoing Monitoring

Open API

Proof of Address

Risk Assessments

Risk Scoring

Workflow Automation

Market Focus

Segmentation

-

Enterprise and upper Mid-Market law firms (Top 100 / Top 200, international and full-service firms).

Target Markets

- Larger professional services firms (legal, accounting, consulting) and other regulated organisations with complex AML/CDD requirements.

- Financial Services; banks, fintechs and payment platforms

Local Group

- InTapp

- First AML

- Aderant

- SS

Data sources and Integrations

Screening / KYC / KYB / Signatures

-

Refinitiv World-Check (sanctions / PEP / adverse media, KYB registries).

-

Thirdfort (KYC / KBA, source of funds, document + liveness)

-

Credas (ID&V, KYC/KYB).

-

Docusign (e-signatures).

Practice Management / CRM / Case Management

-

Intapp

-

Elite 3E

-

Aderant

-

Elegrity

HR / Billing / Other

-

HR: Workday, BambooHR

-

Billing / finance: CMIS, AX, Metastorm

-

Integration middleware: Zapier

-

Government / regulator systems for some use cases (e.g. direct reporting for certain tax authorities in DAC6 flows).

- Zapier

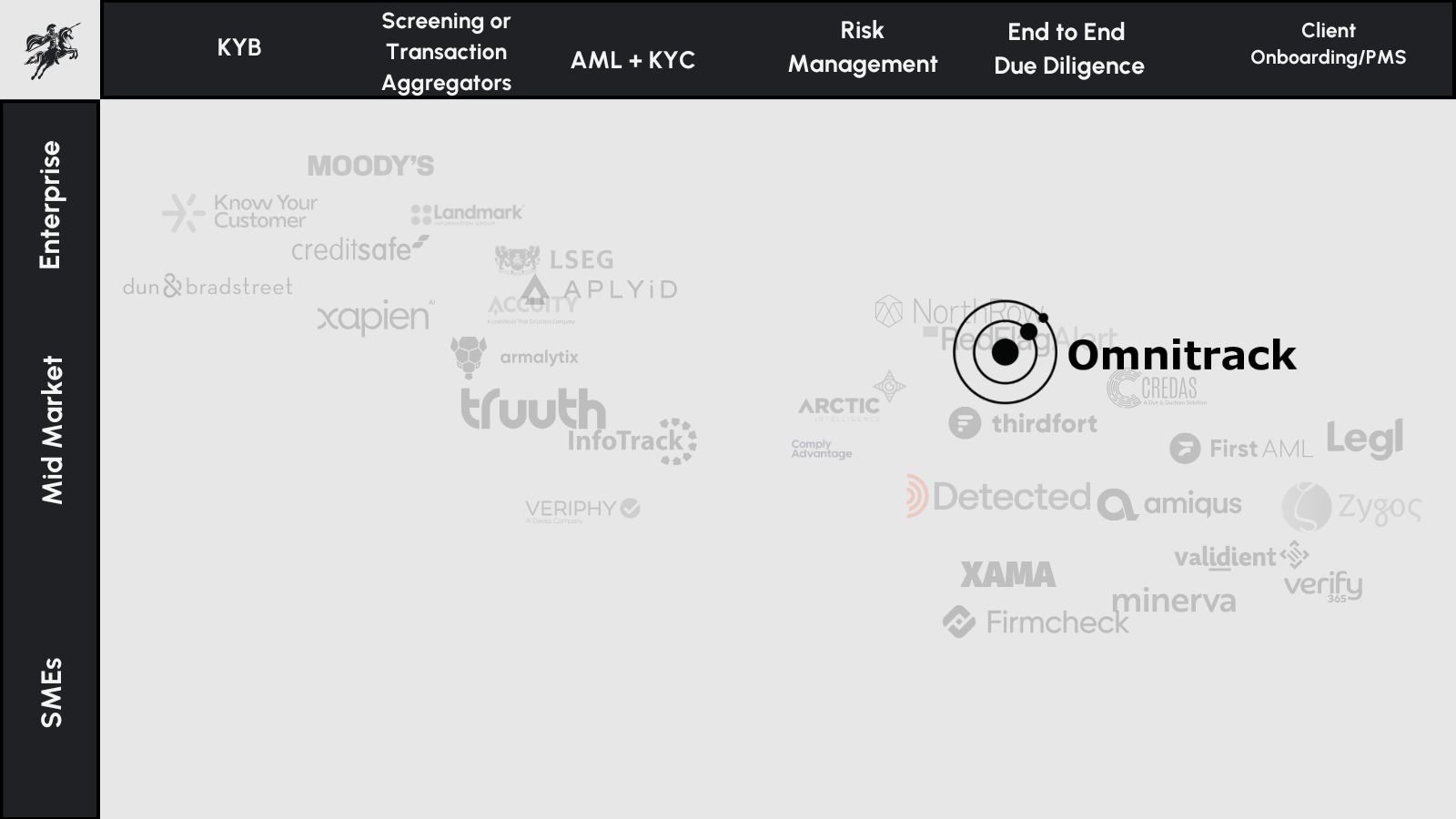

Market Map

Strengths

- Comprehensive platform that covers all aspects of onboarding with deep customisations, workflow automations and a simple onboarding interface that puts everything in one place

- Omnitrack uses conditional logic to scale CDD automatically by client type, jurisdiction, and risk level, so teams apply the right depth of checks every time without relying on memory or manual branching.

- Status tracking, reminder emails, and automated review schedules (high/medium/low risk) prevent missed follow-ups and stale CDD

Weaknesses

- Well suited for larger firms looking for a holistic solution that can plugin existing APIs, rather than out of a gate solution with existing providers

- Not a native verification data provider: Omnitrack relies on third-party KYC/KYB and screening partners, so verification depth and coverage depend on the provider selected.

- The UX/UI for KYB into KYC and Screening could be visualised similar to other competitors with org charts and actionable steps or bulk verification or remediation

Pricing

-

Model: Annual licence + one-off implementation / integration, with tiers by firm size, use-case scope and integration complexity.

-

Typical Law-Firm Range: ~£10,000–£65,000 per year:

-

Lower end: single-jurisdiction use, fewer users and limited workflows.

-

Upper end: top-tier or international firms using multiple workflows (AML, DAC6, registers), with native integrations, translations, historic data loads and/or dedicated hosting.

-

Aventine Rating

Aventine Comment

Raised

Round Details

-

Rounds: Strategic acquisitions (Marlowe plc 2021; Inflexion / Axiom GRC 2024).

-

Total raised: Not disclosed; effectively funded through private-equity-backed corporate acquisitions rather than VC.

-

Primary investor: Inflexion Private Equity Partners (via Axiom GRC).

Investors

-

Axiom GRC