Dun & Bradstreet

Functionality

KYB Aggregator

Description

A global provider of KYB, risk analytics and business intelligence data to financial services and corporates.

Share

Bio

Dun & Bradstreet (D&B) provides business intelligence and data analytics solutions for risk management, compliance, and growth strategies. Its core offering is a vast database of 560 million global business records, updated daily, supporting KYC, KYB, and AML compliance. D&B’s Risk Analytics platform automates due diligence, beneficial ownership mapping, and sanctions screening, targeting mid-market firms and enterprises in financial services, legal, and corporate sectors. The company also offers APIs for bespoke integrations, enabling banks and law firms to merge D&B data with internal systems for financial crime detection and client insights.

Year Founded

1841

Locations

Global

Key Market

Financial Services

Features

Adverse Media

Credit Checks

Financial Data

KYB

Ongoing Monitoring

Open API

Risk Scoring

Screening

Market Focus

Segmentation

- Mid Market

- Enterprise

Target Markets

- Financial services,

- Corporates (such as Apple)

- Professional services (accounting, law, insurance)

- Property

- RegTechs

Local Group

- Moody's

- Experian

- Equifax

- Creditsafe

- Know Your Customer

Data sources and Integrations

-

Global business registries

-

Financial statements and filings

-

Public records and legal filings

-

Third-party data providers

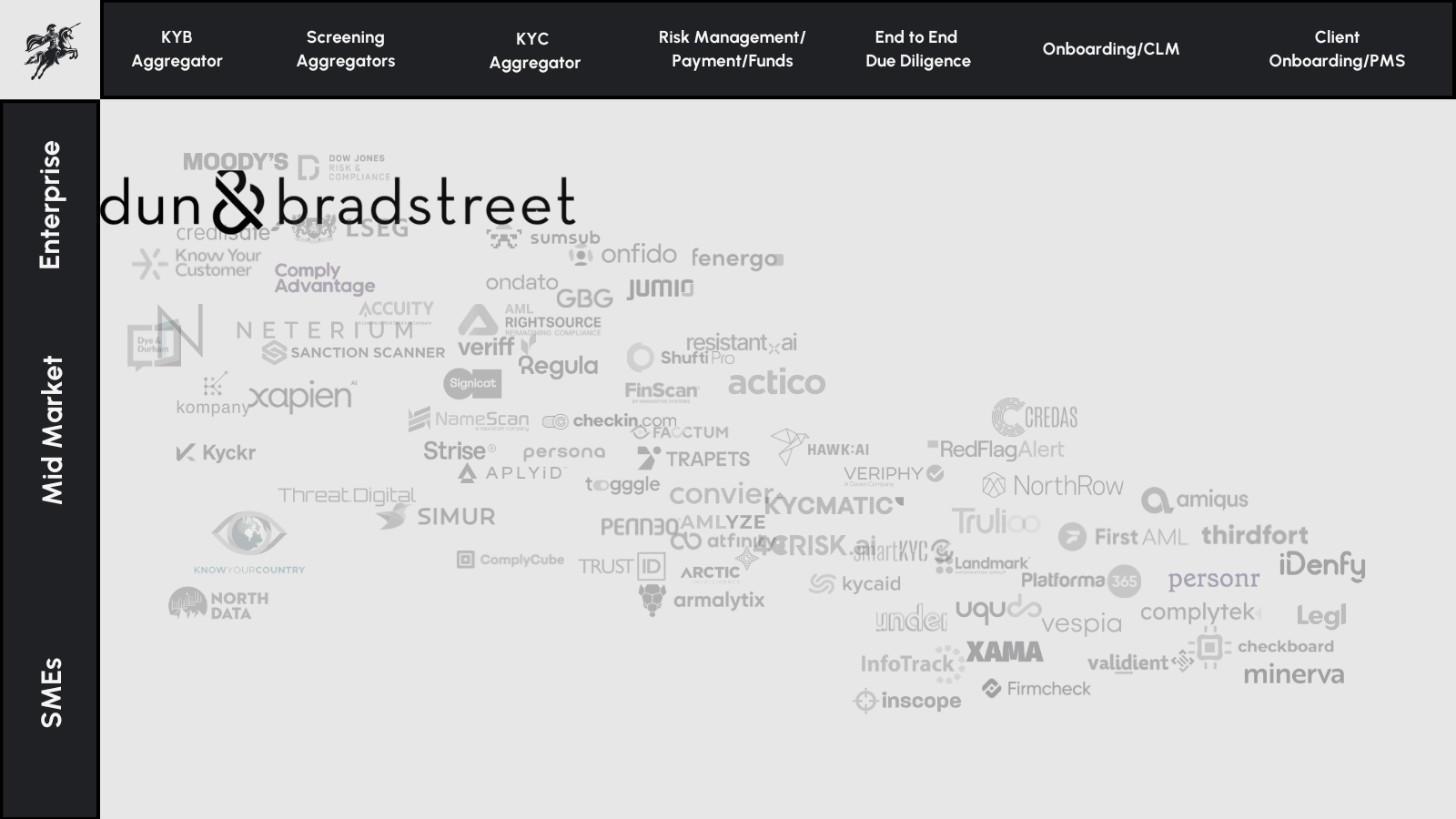

Market Map

Strengths

-

560M business records, 390M shareholder records, updated daily from registries like Companies House.

-

Configurable rules for KYB, UBO mapping, sanctions screening, and risk scoring, with automated workflows.

Weaknesses

- Complex and expensive pricing structures could be a barrier for smaller organisations

- Lacks native biometric/ID verification, requiring third-party vendors for full onboarding flows.

Pricing

- N/A but aprox deal sizes can range from 20 to 50k for mid market and 100k+ for enterprise.

Aventine Rating

Aventine Comment

Excellent for the use of their data via API, used by 9 out of 10 top UK banks and corporates such as Apple - their business ID number is super useful for quick verification of businesses.

Raised

£285m

Round Details

Post-IPO Equity of $375,000,000 Nov 19, 2018

In March 2025, Dun & Bradstreet agreed to be acquired by Clearlake Capital for $7.7 billion.

Investors

Clearlake Capital, with previous investments from CC Capital, Cannae Holdings, and Thomas H. Lee Partners

Executives

Anthony Jabbour

Chief Executive Officer

Richard H. Veldran

CFO

N/A