Membercheck

Functionality

Screening Provider

Description

A comprehensive platform designed to streamline onboarding through end to end due diligence, transaction and ongoing monitoring

Share

Bio

Founded in 2008, MemberCheck provides a secure, web-based solution for organizations to meet their Anti-Money Laundering and Counter-Terrorism Financing obligations. The platform simplifies the end-to-end compliance lifecycle, from initial KYC/KYB onboarding and ID verification to ongoing transaction monitoring and risk scoring. By leveraging high-fidelity data updated daily, MemberCheck helps firms reduce false positives and automate regulatory reporting.

Year Founded

2018

Locations

Global

Key Market

Regulated Entities

Features

Adverse Media

Direct API

KYC

Multi User Access

Screening

Transaction Monitoring

Workflow Automation

Market Focus

Segmentation

- SMEs

- Mid-Market

- Enterprise

Target Markets

- Banking

- Financial Services

- Legal

- Accounting

- Insurance

- Fintech

Local Group

- LexisNexis

- LSEG

- ComplyAdvantage

- DataZoo

- SmartKYC

Data sources and Integrations

- Acuris Risk Intelligence (formerly C6), OFAC, UN, EU, HMT, and 195+ global government/law enforcement lists.

- RESTful API (HTTPS), webhooks for real-time alerts, and manual batch CSV/Excel uploads.

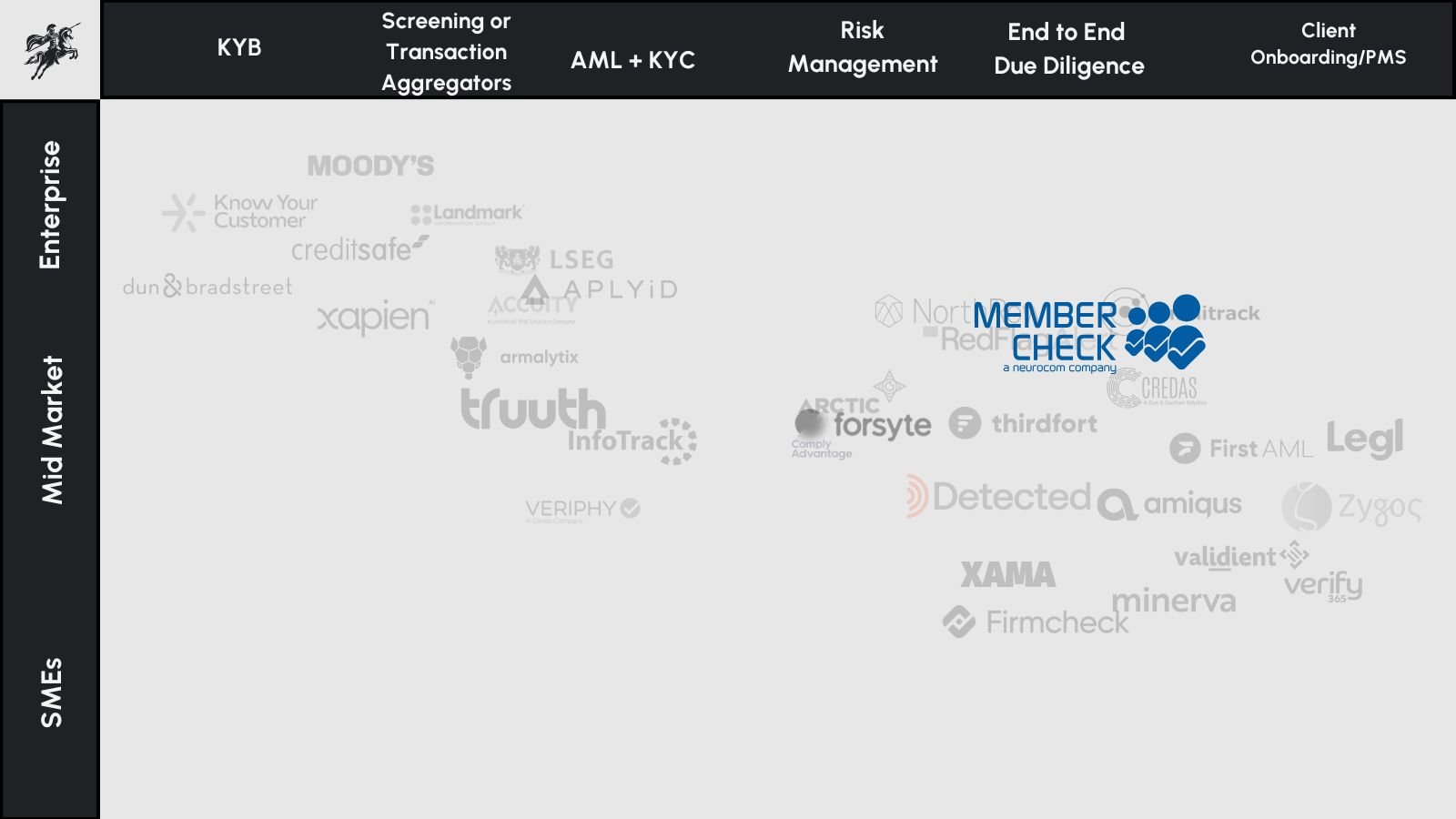

Market Map

Strengths

- Databases are updated every 24 hours, ensuring high reliability for Sanctions/PEP data.

-

Integration Speed: Exceptionally low friction for developers with an average integration time of under 30 days.

-

High degree of control over fuzzy matching thresholds and custom rules engines (FraudShield).

Weaknesses

-

The web platform is often described as "functional and legacy-style," which may feel less modern than UX-first competitors like Sumsub.

-

While dominant in APAC, it has a smaller footprint in the North American market compared to global giants.

Pricing

Custom quotation based on volume and required modules. Generally perceived as "affordable/mid-tier" compared to Tier-1 providers like Thomson Reuters

Aventine Rating

Aventine Comment

A prominent data provider and end to end due diligence verification platform, great company and platform, innovative, decent price and solid product

Raised

N/A

Round Details

Primarily privately held; strategic backing from parent company GPayments.